Out-Of-Town Lender Risks

Here’s what happens when buyers bring in national lenders or banks from hours away:

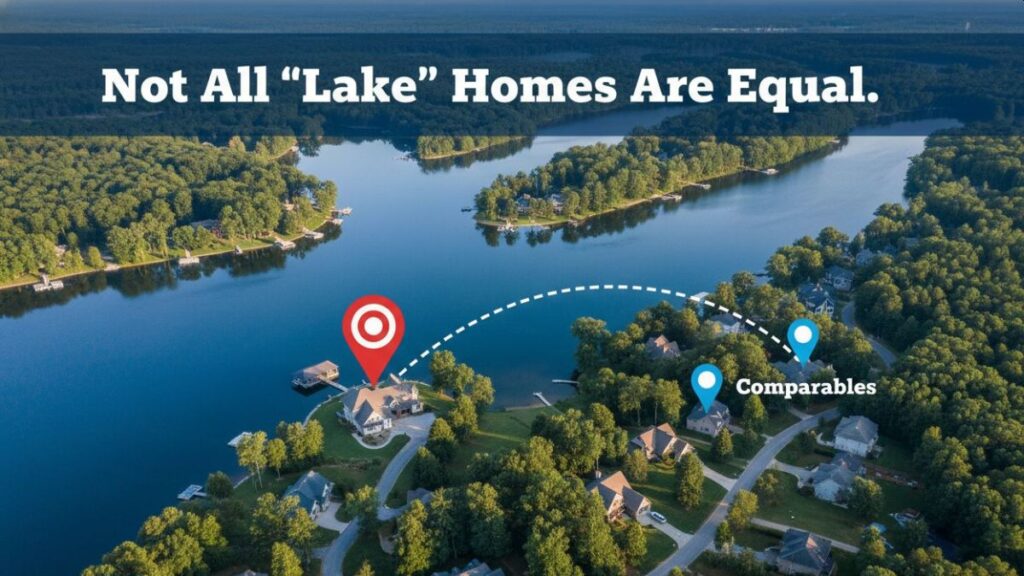

- They send appraisers who are unfamiliar with the lakefront market, which can lead to missing what makes one property more valuable than another.

- They use “near the lake” comparables instead of true waterfront sales, which can drag down appraisals.

- They route underwriting through far-off committees with no local context.

- Out of area lenders typically have higher interest rates and/or higher closing costs for a second home buyer.

The fallout? Deals stall. Closings are delayed. Sellers lose confidence. And sometimes the deal falls apart completely, or worse, the deal closes and the buyer is left holding a bag of issues their out-of-town lender or agent didn’t know existed.

Most people assume a lender is a lender. They figure if their bank approved them for a city condo or suburban home, the same rules apply at the lake. That belief costs buyers homes every single year. The lake market has unique dynamics, and lenders who don’t live and work here often don’t understand how to handle them.

Because the lake home market in Southwest Michigan is unique, it presents challenges unfamiliar to lenders and agents from outside the market. To effectively represent buyers and sellers in this market, you need to work here to understand it.

There’s no other way around it.

If you choose a professional who doesn’t specialize in lake homes in this region, they won’t know to ask the right questions or guide you in a manner that takes full advantage of the market. The same is true for a lender. It’s an unnecessary risk.

I’ve seen well-qualified buyers miss out on homes they loved, not because they lacked the funds, but because their financing partner was the weak link. That’s avoidable if you know where the pitfalls are, and the only way to know them is to specialize in this market.

Stories We’ve Seen That We Can’t Unsee!

I’ll never forget the $700,000 deal that collapsed over a $10,000 appraisal error. Every comparable the appraiser used was wrong, and I had personally sold the correct ones that should have been considered.

Another time, a Fortune 500 executive ignored my advice and stuck with his national bank. They swore they would close by Labor Day. They didn’t. His family spent the holiday without their lake house, waiting due to needless paperwork delays.

And just recently, a deal nearly fell apart because the lender missed a simple update in the buyer’s application. The seller had a backup cash offer ready to go. That buyer saved the deal only by putting down $50,000 in a non-refundable earnest money deposit.

These aren’t random exceptions. They’re repeated patterns when buyers use lenders who don’t understand lakefront real estate.

Why Local Wins

Local lenders know these lakes inside and out. They understand which shorelines command premium value, which townships require extra hoops, and which builders carry weight. That knowledge matters.

They also:

- Use appraisers with real expertise in waterfront property.

- Move files faster without passing them through faceless review boards.

- Protect buyers from embarrassing last-minute blowups.

Just as important, sellers and listing agents recognize the names of trusted local banks. A pre-approval from them carries weight. It signals that the deal is solid, which can make all the difference in a competitive situation.

Insider Answer: Picking Your Lender Wisely

A local, experienced Realtor® can guide you to the best local lenders. Here’s what I always share with my clients about lenders:

- Your lender is your teammate. If they don’t know lake-specific rules, they’ll slow you down.

- A known name builds trust. Sellers see a local lender’s pre-approval as a green light.

- The process goes smoothly. From appraisal to underwriting, a local lender knows how to keep things on track.

- Speed wins homes. In multiple-offer situations, a local lender can move quickly and give you an edge.

This is why I don’t just warn buyers about lenders; I hand them two or three trusted local contacts. My job is to make sure financing isn’t the reason they miss out on a property they love.

Local Context: Southwest Michigan’s lakes

Here in Southwest Michigan, timing matters. Summer homes are often listed in late spring, and serious buyers want to be in by Memorial Day or the Fourth of July. Out-of-town lenders rarely match that pace.

Waterfront appraisals are also tricky. The difference between an all-sports lake, a no-wake lake, or one with strict township rules can mean tens of thousands of dollars in value. Local lenders and appraisers know those nuances. That’s why deals with them close more smoothly, and why sellers prefer them.

The reality is simple: Buyers who secure their dream lake homes are usually the ones who listen early and line up financing locally.

What Lake Home Buyers Ask Me About Lenders

Do I have to use a local lender for a lake home?

No, but it’s the smart move. Local lenders understand waterfront values in ways national banks can’t.

Will a local lender cost me more?

Not usually. In fact, local lenders often save buyers money by preventing bad appraisals or delays that cause extra expenses.

What if I already have a relationship with my hometown bank?

You can keep it, but I strongly recommend also applying with a local lender. Having that approval in hand protects you in case your out-of-town bank slows down.

Ready To Buy Smart?

The difference between buying a lake house and losing one often comes down to lender choice. Don’t let an out-of-town bank cost you the property you’ve been dreaming about. Start your conversation with us today, and I’ll connect you with lenders who know these lakes, know the rules, and know how to get you into your home on time.